contra costa tax sale website

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. The median property tax in Contra Costa County California is 3883 per year for a home worth the median value of 548200.

California Public Records Public Records Public California

California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated.

. Home Blog Pro Plans B2B solution Login. This 225 difference is a good indicator of the quality of the infrastructure the school district and public utilities that are funded by tax revenue in your neighborhood. Find Contra Costa County residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions.

Contra Costa County collects on average 071 of a propertys assessed fair market value as property tax. He serves as ex officio member on the Countys Retirement Board representing the county at large. Please make your deposit well in advance of the auction in order to ensure your eligibility to bid.

Home Blog Pro Plans Scholar B2B solution Login. Free Contra Costa County Assessor Office Property Records Search. Your deposit must be received by Bid4Assets NO LATER THAN 400 PM ET 100 PM PT Tuesday February 14th.

Wwwcctaxus Comments or Suggestions. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Contra Costa County CA at tax lien auctions or online distressed asset sales. The Contra Costa County Treasurer-Tax Collector is committed to providing quality services to the public.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Contra Costa County Property Records are real estate documents that contain information related to real property in Contra Costa County California. A single 5000 deposit plus a 35 non-refundable processing fee is required to participate in the Contra Costa County Tax Sale.

The Contra Costa County Sales Tax is collected by the merchant on all. The California state sales tax rate is currently. Contra Costa CA Treasurers Office is offering 39 parcels for auction online.

Advanced searches left. 2019 Contra Costa County Treasurer-Tax Collectors Office 625 Court Street Room 100 P. Ad Find Foreclosed Properties at Huge 50 Savings.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Contra Costa County California is. 1 To See All The Listings.

Sale of Tax-defaulted Properties. Contra Costa County has one of the highest median property taxes in the United States and is ranked 72nd of the 3143 counties in order of median. Can be used as content for research and analysis.

California has a 6 sales tax and Contra Costa County collects an additional 025 so the minimum sales tax rate in Contra Costa County is 625 not including any city or special district taxes. These are all NO RESERVE auctions. 925 608-9500 FAX925 608-9598.

Method to calculate Contra Costa County sales tax in 2021. Watts was first elected in June 2010 as Treasurer and Tax Collector of Contra Costa County Watts is responsible for the collection safeguarding and investment of over 35 billion in public funds. Bids start as low as 550000.

Collected from the entire web and summarized to include only the most important parts of it. In a public oral bid tax sale where Contra Costa County California is utilizing the Premium Bid Method the winning bidder at the Contra Costa County California tax sale is the bidder who pays the largest amount in excess of the delinquent taxes delinquent interest and fees. Contra Costa County CA currently has 942 tax liens available as of March 24.

This table shows the total sales tax rates for all cities and towns in. The Contra Costa County sales tax rate is. The sale of Tax-defaulted Property Subject to Power of Sale is conducted by the Contra Costa County Treasurer - Tax Collector pursuant to the provisions of the Revenue and Taxation Code and written authorization of the Board of Supervisors.

The excess amount shall be credited to the county. Sales Tax Primer PDF 2020. Search only database of 8 mil and more summaries.

The current total local sales tax rate in Contra Costa County CA is 8750. 925 608-9500 FAX925 608-9598 WEB. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Detailed listings of foreclosures short sales auction homes land bank properties. The Contra Costa County Treasurer-Tax Collector is committed to providing quality services to the public. Look up the current sales and use tax rate by address.

Search only database of 74 mil and more summaries. He also serves on the Countys Debt Affordability Advisory Committee and. Contra Costa Property Tax.

Advanced searches left. 2020 - Quarter 4 Not Yet Released 2020 - Quarter 3 PDF 2020 - Quarter 2 PDF 2020 - Quarter 1 PDF 2019. Collected from the entire web and summarized to include only the most important parts of it.

Can be used as content for research and analysis. Box 631 Martinez California 94553-0063 Office Hours 8AM - 5PM Except Holidays Call Center Hours 9AM - 4PM Except Holidays PHONE. The average sales tax rate in California is 8551.

2019 Contra Costa County Treasurer-Tax Collectors Office 625 Court Street Room 100 P. A single 5000 deposit plus a 35 processing fee is required to participate in the Contra Costa County Tax Sale. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more.

Even everyday living in Contra Costa County is more expensiveas one indicator while the sales tax rate in California is 6 sales tax in Contra Costa County is 825. Box 631 Martinez California 94553-0063 Office Hours 8AM - 5PM Except Holidays Call Center Hours 9AM - 4PM Except Holidays PHONE. Search For Cheap Houses Starting from 10000.

The December 2020 total local sales tax rate was 8250. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Contra Costa Tax. Please let us know by using our on-line.

For Sale 942 Loch Glen Pl Langford British Columbia V9b4z5 896879 Realtor Ca

Recently Sold Homes In Contra Costa County Ca 52 058 Transactions Zillow

Search Parameters Open House Dreaming Of You Selling House

Contra Costa County 378 Updates Mdash Nextdoor Nextdoor

Contra Costa County Ca Recently Sold Homes Realtor Com

El Cerrito Contra Costa County Ca Multi Family Homes For Sale Real Estate Realtor Com

Contra Costa County Ca Recently Sold Homes Realtor Com

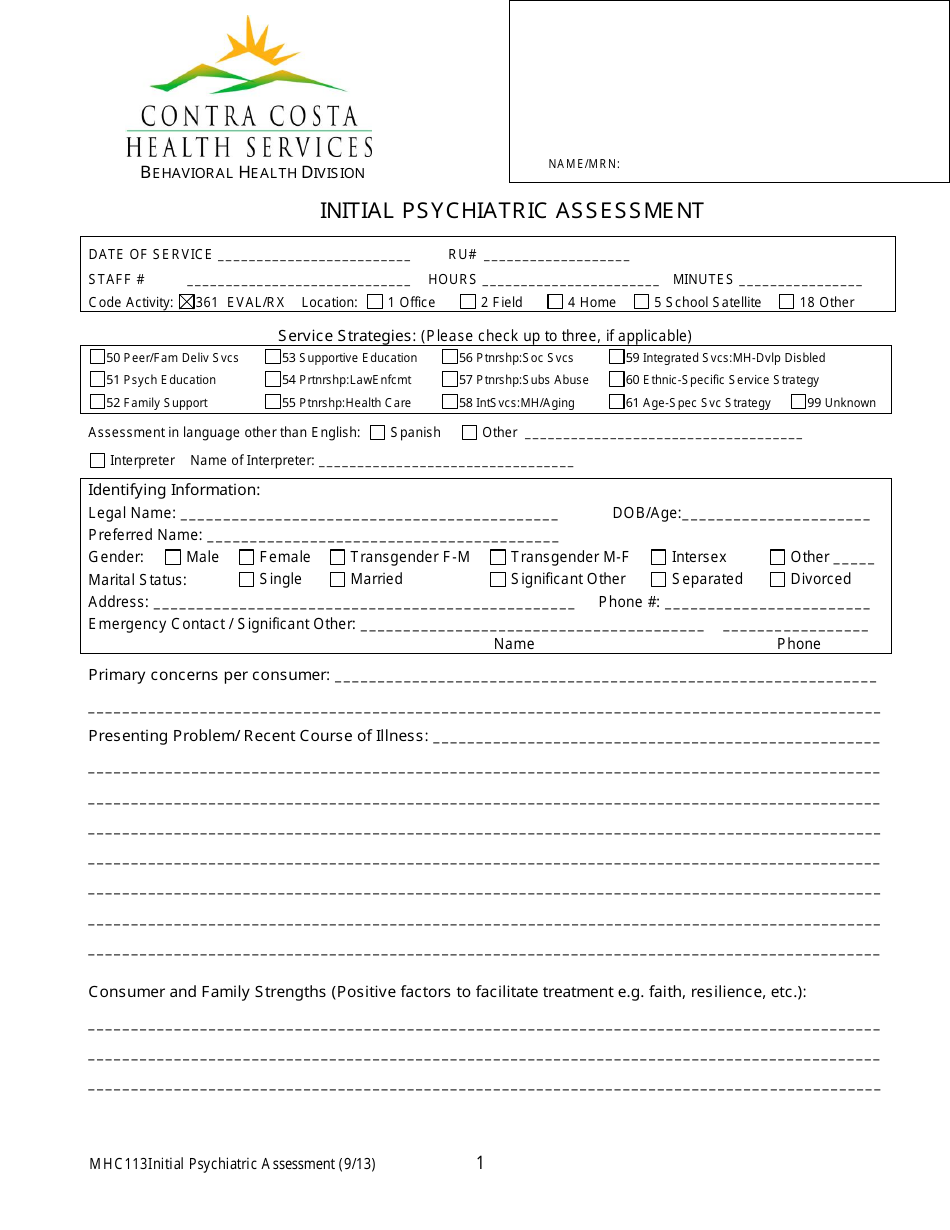

Initial Psychiatric Assessment Form Contra Costa Health Services Download Printable Pdf Templateroller

1121 Contra Costa Dr El Cerrito Ca 94530 Realtor Com

See District Lines Redrawn In Contra Costa County San Ramon Ca Patch

House For Sale Brochure Template Beautiful Flyers For Selling Houses Marketing Advertising Real Estate Flyers Real Estate Flyer Template Sale Flyer

Recently Sold Homes In Contra Costa County Ca 52 058 Transactions Zillow

Contra Costa County Da Fbi Investigating East Bay Officers Kron4

Understanding Prop 19 S Impact On Older Homeowners Contra Costa Senior Legal Services